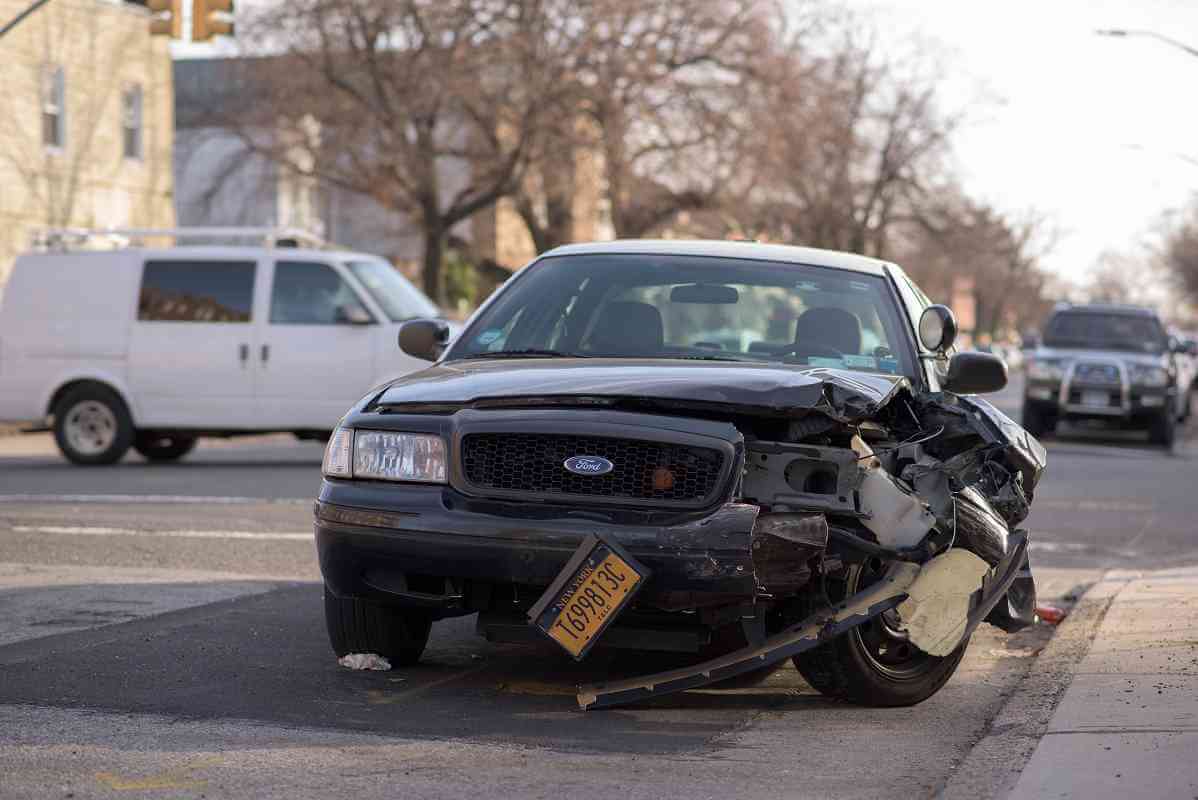

Did you know over $150 Billion are paid out by insurance companies in a single year in the United States? Knowing what to do in case of an accident can save both time and unnecessary stress. Although we hope to never have to file a claim, it can (and does!) happen. Here are some things you should know when it comes to filing.

Steps to Filing a Car Insurance Claim

1. Contact your insurance company

You will need the following information:

- Who was driving

- Which vehicle was involved

- Description and severity of the accident

- Location and Time

- Name and Contact Information of everyone involved, including witnesses

2. Don’t forget to file a police report

You will need to provide a police report number. You can file a report at the police station, if no police are there to write a report at the scene.

3. Find out what documents are needed to support your claim

Your insurance company will require a proof of claim form, in addition to any other relevant documents. Don’t forget to ask what exactly is needed!

4. Follow up with your insurance adjuster

The insurance company will assign an adjuster to your claim. The adjuster will most likely need to contact you for additional information. Provide only facts and try to avoid speculation when describing the accident. You may need to share witness information, as well. Remember, the conversation will be recorded and used to help determine who was at fault. If you are filing a personal injury claim with the other driver’s insurance company, you may want to contact an attorney before proceeding.

The adjuster will also need to either inspect the damage to your vehicle, or ask you to take the car to a certified repair shop to have an inspection performed.

5. Find out if your policy covers a rental car

If your car needs to be in the shop for repairs, a rental car

6. Understand the timing of your claim

In order to avoid missing any deadlines, be sure to speak with your insurance agent about what is needed and when.

7. Accept payment

The adjuster will evaluate all the facts of the accident, in addition to your policy before authorizing a final payment. You will need to sign a release, in order to accept payment and close the case.

In case of Medical Care

It’s imperative to prioritize your health and well-being after a car accident. In order to avoid complications down the road, don’t ignore any accident-related pains. Although many health care providers will likely be willing to bill insurance companies directly, you may need to submit the medical bills to the insurance company in order to receive reimbursement.

If you have injuries that are caused by another driver, contacting an attorney to represent you will likely make it much easier for you. Many attorneys provide free consultations and represent a driver on a contingency basis (only getting paid if claim is approved).